Credit: Unsplash/CC0 Public Domain

Genetics can be associated with one's behavior and health—from the willingness to take risks, and how long one stays in school, to chances of developing Alzheimer's disease and breast cancer. Although our fate is surely not written in our genes, corporations may still find genetic data valuable for risk assessment and business profits, according to a perspective published in The American Journal of Human Genetics. The researchers stress the need for policy safeguards to address ethics and policy concerns regarding collecting genetic data.

At-home DNA tests have provided millions with insights into their family history and health risk by simply spitting in a tube. Genetic risk screening of embryos at in vitro fertilization clinics is now available. These tests rely on polygenic scores—a tally of variations in human genes that influence a certain trait. However, while powerful at predicting traits in large populations, these scores are rather weak at an individual level.

"And for that reason, people have said, 'we don't need to worry about companies wanting to use this information at the individual level because it's not very informative,'" says economist and co-corresponding author Nicholas Papageorge of Johns Hopkins University. "Well, that's not exactly true. Firms operate under a lot of uncertainty and any little bit of information that they have about you is worthwhile."

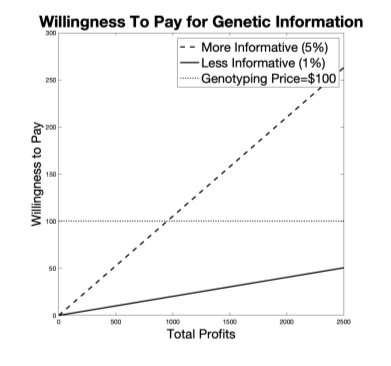

Using an economic model, the researchers found that companies might be willing to pay for a consumer's polygenic score even if it's only marginally accurate as a predictor, because the information may raise profit and is relatively cheap. For example, knowing a person's polygenic score, such as risk of cognitive decline or risky behaviors, an insurance firm may tailor their offerings to individuals, decline insurance, or raise premiums.

The economic model shows that companies' willingness to pay for a type of genetic information called a polygenic score increases with expected profits. As the score becomes more informative, the dollar amount companies are willing to pay rises, potentially exceeding the $100 genotyping cost. Credit: Nick Papageorge/Johns Hopkins University

"And it might be counterintuitive, but there might be welfare-enhancing uses of such data," says co-corresponding author, legal scholar, and bioethicist Michelle Meyer of Geisinger College of Health Sciences.

For example, financial service companies may develop products that reduce financial decision-making burdens or offer error monitoring services for people at high polygenic risk of Alzheimer's. "But I do think it's fair to say the burden is on the firm to explicate and help develop appropriate guardrails to prevent nefarious uses."

The researchers argue that current laws and policies are inadequate to address the ethical, privacy, and legal concerns surrounding the potential corporate use of polygenic scores. While the US Genetic Information Nondiscrimination Act prohibits discrimination in health coverage and employment based on genetic information, there are loopholes. The act only covers health insurance, excluding long-term, disability, life, and other insurances. It also doesn't apply to employers with fewer than 15 people, which accounts for 85% of US companies.

"This is a wake-up call to people and to those who are in a position to act," says Meyer. "We need to put things in place now—or yesterday."

"I don't think people realize that when they give up their genetic information today, they're not giving it up just for today; they're giving it up forever," says Papageorge. "When there's new science, they know a little bit more about you."

More information: Potential Corporate Uses of Polygenic Indexes: Starting a Conversation about the Associated Ethics and Policy Issues, The American Journal of Human Genetics (2024). DOI: 10.1016/j.ajhg.2024.03.010. www.cell.com/ajhg/fulltext/S0002-9297(24)00083-1

Journal information: American Journal of Human Genetics

Provided by Cell Press